We focus on Credit Enhancement by using Metro 2 Compliance to challenge negative or erroneous information on your credit report.

We will analyze you credit reports and identify all negative items that’s effecting your credit score. We will customize a plan that will outline all actions that need to be taken during your credit restoration process.

We will challenge all negative items identified with all three credit bureaus and creditors that’s listed on your credit report. If items cannot prove to be accurate, fair or substantiated the credit bureaus and creditors are required by law to remove each item.

It can take up to days or months to see a change. When a negative item is removed from your credit report take a moment to celebrate but remember this is only the beginning. We will review what has been removed and what is still on your credit report then tackle the other questionable items still on your reports.

A credit score is a number between 350 and 850 that predicts how likely you are to default/fail to

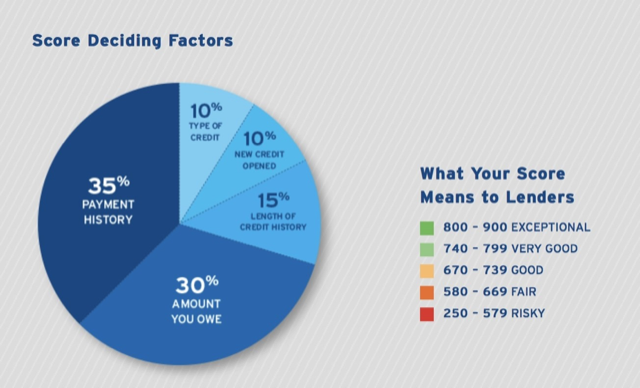

pay a loan. There are five factors that make up your score…

Consistency of payments on your credit card balance.

You are a risk you the loaner when you max out your credit cards.

The legnth of time each of your accounts have been open and last active.

Opening new accounts normally versus opening too many at once.

A variety of loan types is better than a lack of variety.

If so, then partner with us to get your clients creditworthy. When you refer your credit challenged client to us, we will work in record time to increase their credit score and get them back to you to close the deal.

Schedule AppointmentDeep analysis of report.

Challenge questionable items.

Analyze the updates and replies.

Receive financial education weekly.